ASSETSVALUE provides an economic translation of strategic decisions in the form of profits and loss of profits ("lucrum cessans") valuation, allowing to achieve maximum tangible gains for an organization, proposing strategic decisions with strong technical and financial arguments.

Success case →

Renewable energy production assets renewal plan

|

The ACTUAL LIFE is

%

longer than the lifespan estimated by the manufacturer |

The LOSS OF PROFIT , considering the current renewal plan is equal to

%

of the replacement value for each alternator* *the value corresponds to a few million euros |

The FINANCIAL DEFICIT is equivalent to

%

of the replacement value of a new alternators group*, considering the current renovation plan * the current power plant has 20 alternators |

|

A company specializing in the production of renewable hydroelectric energy has a plant made up of twenty alternators, for which the question of its renewal is raised. A renewal plan was therefore considered, taking into account the lifespan estimated by the manufacturer, to maintain the expected production performance of these alternators. The company has a budget limit that only allows the replacement of one alternator every two years. The company wants to estimate the risk exposure to which it was exposed considering these restrictions. Vertical Divider

|

→ ASSETSMAN proposed solutions using its ASSETSVALUE tool (decision-making tool in the management of asset management). By carrying out Risk / Cost optimization studies, ASSETSMAN was able to provide precise calculations for: • THE ACTUAL LIFE of the alternators based on the modeling of their reliability. • The determination of the opportune moment for the replacement of the alternators and the estimate of the LOSS OF PROFIT, if this moment is postponed. • THE FINANCIAL DEFICIT* to which the company is exposed with its current organizational constraints. * financial deficit: accumulated loss of profit, resulting from replacement postponements. |

OPTIMIZATION OF PREVENTIVE MAINTENANCE INTERVALS

|

New calculated maintenance interval

Refurbish the equipament every

years

|

Savings of

K$ / year

compared to current situation

years

|

Savings of

K$ / year

Compared to a more conservative preventive maintenance interval :

years

|

|

Client's needs :

The preventive maintenance interval of a machine is problematic for the customer. It follows the guidelines of the manufacturer, renewing every 10 years his lifting tool. The client wants to review the preventive maintenance intervals of his tool given that he noted a tool breakage level of 5%, in 7 years. The maintenance constraints of the tool are as follows: • Replacement cost: € 470K • Intervention time: 10 days Vertical Divider

|

→ • Valuate the cost of the current preventive maintenance task • Define the maintenance interval for which cost price is the lowest • Valuing gain between Assetsman result and the client's current policy. |

OptimiZATION OF MAJOR MAINTENANCE SHUTDOWNS

|

Simulation of

different preventive maintenance tasks.

|

Planning of

stop out of

or minus 1 stop by year |

Savings of

% of annual costs on major maintenance shutdowns.

|

|

Client's needs :

The client wants to reduce low risks major maintenance shutdowns's annual costs. Management of 2 cases grouping 70 equipments of 4 different families. The major maintenance shutdowns costs is between 1 and 4 million euros. Vertical Divider

|

→ • Value with precision the annual costs of major shutdowns of the client. • Determine for each task the appropriate moments of realization • Converge for all these tasks towards a common Optimum with the best compromise between risk and cost • Valuing gain between Assetsman result and the client's current policy. |

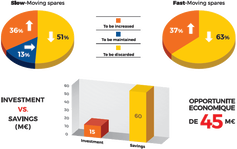

OPTIMIZING THE MANAGEMENT OF SPARE PARTS OR STOCKS

|

Client's needs :

Spare parts storage policy considered too conservative by the customer. He wants to implement an evaluation and optimization of the stock policy to obtain economy. The study concerns 45.000 spare parts, 3 production plants with 10 independent stations. The stock policy currently is cautious, since the client has to assure the continuous supply of electricity and water. The client's objective is to define which spare parts should be reduced, kept, or raised. Vertical Divider

|

→ • Value the customer's current stock in terms of cost and risk. • Define a level of risk granted by the client. • Reshape the stock according to this risk • Define the new storage policy • Valuing gain between Assetsman result and the client's current policy. |

OptimiZATION OF MAJOR MAINTENANCE SHUTDOWNS

|

Reduction of

% in the operations of maintenance control and review of TPM standards

|

Gain of

hours of workforce |

Reduced machine downtime for preventative maintenance of the order of

hours

|

|

Client's needs :

Availability of equipment deemed insufficient by the customer. He / She wishes to set up an approach to improve the availability of production tools, and in particular : • Reduce failure rates • Reduce recurring anomalies • Reduce downtime for Preventive Maintenance Vertical Divider

|

→ • Implement the CBA method (Core Business Analysis) : identification of equipment that prevent the achievement of availability objectives (bottleneck). • Conduct training RCM and RCA methods (more than a hundred people trained) • Conduct 9 pilot studies for all relevant workshops • Team management as part of the multiplication of the on-site approach |